how to open tax file in bangladesh

Address current and permanent 5. Tax return filing and tax payment relief.

13 Digit Bin Registration In Bangladesh How To Get Bin Certificate Bin Registration Bangladesh Youtube

Click Filing under Task OR select.

. Click Continue under the return you want to open or. An additional surcharge of 25 percent on income of companies in the tobacco sector. Tax return filing and tax payment relief measures COVID-19 Bangladesh.

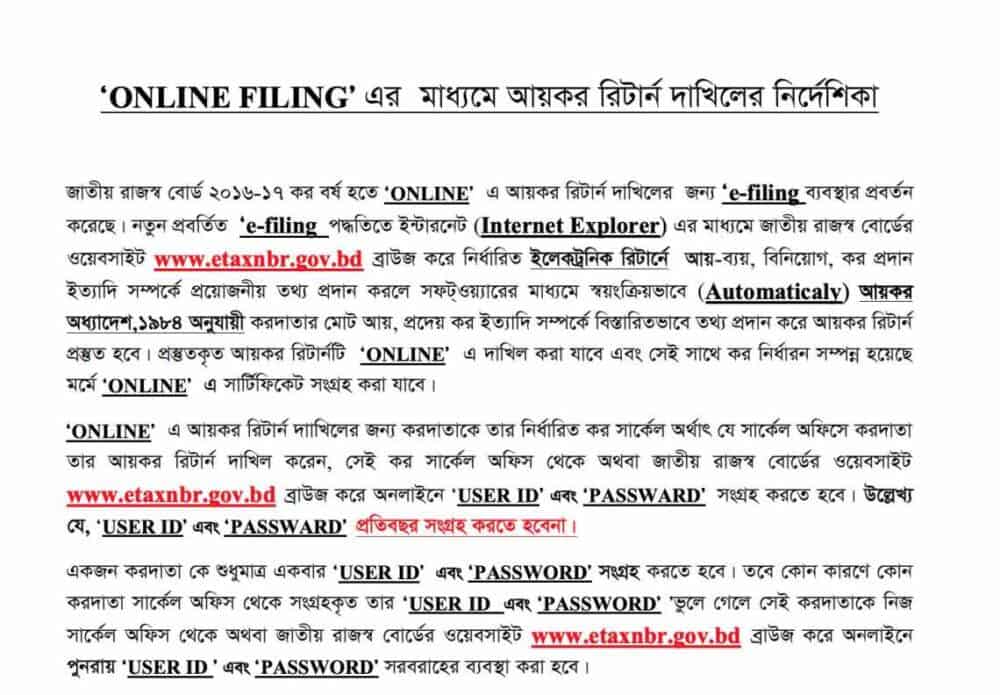

From the homepage Taxpayer clicks Register Account tab. An overview of Individual Income Tax in Bangladesh. Exercise increased caution in Bangladesh due to crime terrorism and kidnapping.

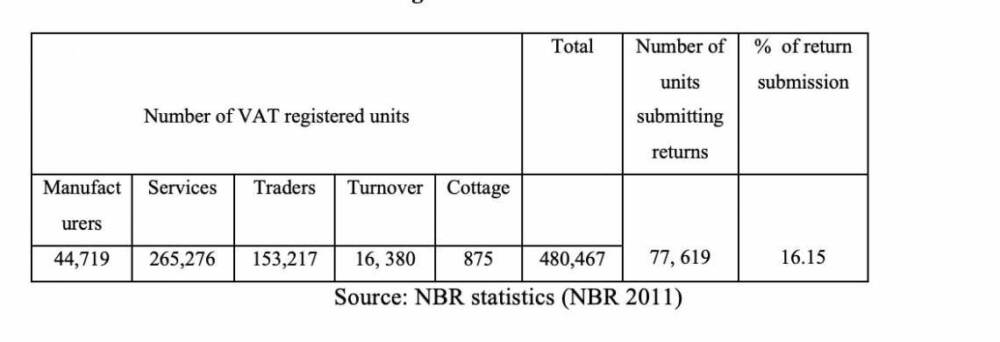

Once you have logged in a list containing all your tax filing obligations is displayed under the Task Overview tab. Value-added tax VAT is levied on the importation of goods and the making of taxable supplies in the course of carrying out a taxable activity. In Bangladesh withholding taxes are usually termed as Tax deduction and collection at source.

The standard rate is 15 percent. Any non government organization registered with NGO Affairs bureau. A person shall file a return of income to the DCT of the income year.

In Bangladesh the crime rate impacting foreigners is generally low. Crimes such as muggings burglaries assaults and illegal drug trafficking constitute. Create a User ID by proving necessary informations in the Registration form.

In this video I will show Income from house property Income tax return filing 2020-21 in Bangladesh how to file house property income. In order to obtain a User ID and password to open an account a phone number needs to be provided to the portal. As per the requirement stated in the Finance Act 2017 if any person earned more than Tk.

Configuring Mozilla Firefox and Interner Explorer for Submitting Online Income Tax Return in Bangladesh using Adobe Acrobat Reader DCLatest Adobe Acrobat Re. The tax law imposes income tax at 25 percent on listed entities and 325 percent for non-listed entities. After launching the TurboTax program you can either.

250000 during the income year then that person needs to file. Time limit to submit the return and supporting documents. A countrys great source of income is its population.

Certificate of tax collected at source Doc Certificate of tax collected at source Pdf Certificate of tax deducted at source Doc Certificate of tax deducted at source Pdf Monthly Statement of Tax Deduction from Salaries Pdf. Primary Information of Assesses. You can calculate yo.

At First Visit the Website httpssecureincometaxgovbdTINHome. An individual can follow two procedure to file the return one is universal self assessment procedure and normal procedure. 13 Tax withholding functions.

An individual must file tax return within 30th November with all related supporting documents. First you have to click on the Registrar button then you have to register with the User ID Password Security Question Email Address and Mobile Number. For employees income from salary.

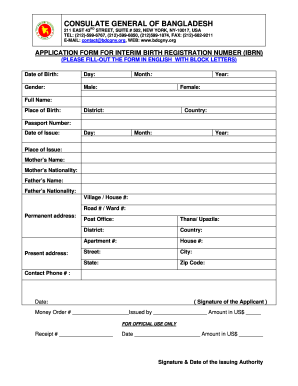

It is a system guided easy-to-use tax preparation software that will save you time money and help you reduce any tax potential audits by the Government. A if the total income of the person during the income year exceeds the minimum tax threshold under this Ordinance. Taxpayer accesses the address httpetaxnbrgovbd.

The government on 7 May 2020 approved draft legislation to extend the time for taxpayers to file their tax returns and to pay their taxes as relief measures in response to the coronavirus COVID-19 pandemic. In order to verify a persons status of income. Select Open Tax Return from the File menu Windows or TurboTax menu Mac browse to the location of your tax or tax data file not the PDF select it and then select Open.

Reduced rates are available depending on the nature of the taxable supply which ranges from 0 percent to15 percent. You might need to register for new eTIN numbers online. C if the person is-.

Return-Business Professional income upto 3 Lakh- IT11CHA. Now people of Bangladesh can open their eTIN account within just 10-15 from online. Obligation to file tax return.

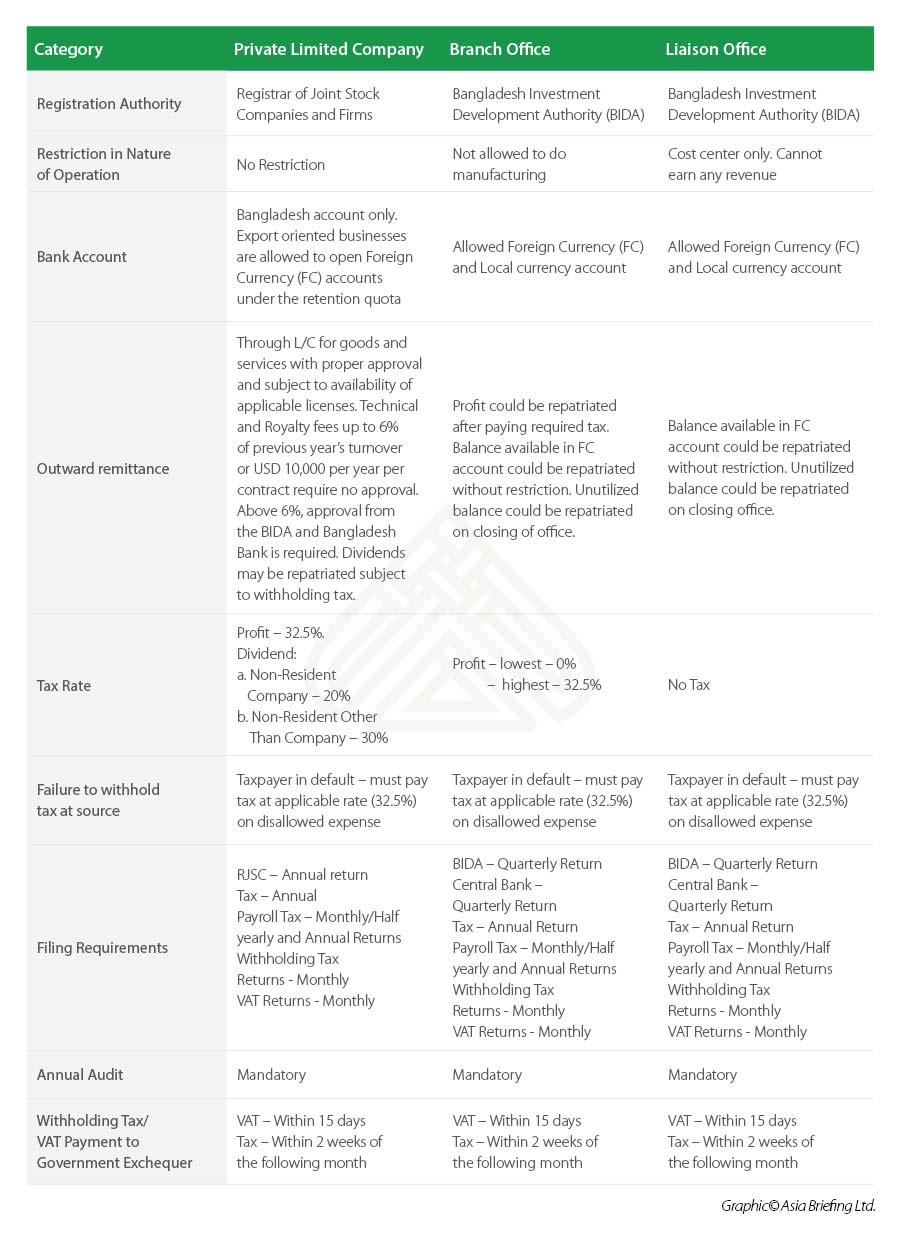

Immediately a message will be sent to your mobile number. Required Document for Submission of TAX RETURN Document Needed for Submission of TAX RETURN. Corporate tax rate changes announced this year include.

Exchequer through pay order treasury challan or online via. The following is a step by step guidelines on the individual income tax return filing in Bangladesh. A copy of the previous years return if you have already submitted the return.

Our taxation services at FM Consulting International ensure both advantage to the individual and compliance according to Bangladesh taxation policy. Now type the code found in the e-tin activation page and click on the Activate button. Choose the online account application form and clicks the link Click here.

However travelers should be aware of petty crimes such as pickpocketing in crowded areas. The system displays an online account registration application and Taxpayer saves application form to his computer. The National Bureau of Revenue NBR of Bangladesh has fastened the process of registering for E-Tin in Bangladesh.

VAT operates in Bangladesh partly as a sales tax. After assessing the amount of income tax every assessee shall deposit the amount to the govt. Pictures for the first time.

B if such person was assessed to tax for any one of the three years immediately preceding that income year. Please note that youll need to use the same tax-year TurboTax program to open. Out of this profit only income tax will generate 8500000 million taka which is 111.

A reduction of the corporate income tax rate for companies in the readymade garments sector to 15. A taxpayer can file an appeal against DCTs order to the Commissioner AppealsAdditional or Joint Commissioner of Taxes Appeals and to the Taxes Appellate Tribunal against an Appeal order. In the budget for the 2006-07 fiscal years government had estimated total tax revenue of 42915450 million taka including both NBR and non NBR revenue of total receipt of 76558618 million taka which is 616 of total receipt of the country.

The typical eTIN number is 12 digit and if you had any TIN numbers before. The government earns by levying tax on the income generated by the population.

The Growth Of E Commerce During The Pandemic In Bangladesh

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Sample Quotation Format Template Google Docs Google Sheets Excel Word Template Net Quotation Format Quotation Sample Quotation Format In Word

Advance Income Tax Bangladesh Advance Income Tax On Imports To See Major Overhaul

Bangladesh Slips 17 Notches On Economic Freedom Index

Buy Amul India Twilight Tryst Single Origin Dark Chocolate 125g Online In Bangladesh From Cellsii Com Tease And Indulge Your S Amul Dark Chocolate Chocolate

Bangladesh Tax Return Filing And Tax Payment Relief Kpmg United States

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Evisitor Visa Subclass 651 Australia Travel Visa Visa Information

Import Your Excel Data To Tally In Matter Of Minutes Get Excel To Tally Module Save Your Precious Time Click To Know More Https Excel Grow Business Data

Bangladesh New Method Of Online Tax Returns In The Offing Tech Observer

Starting A Business In Bangladesh Common Legal Entity Options

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Bangladesh Digital Birth Certificate Download Fill Out And Sign Printable Pdf Template Signnow

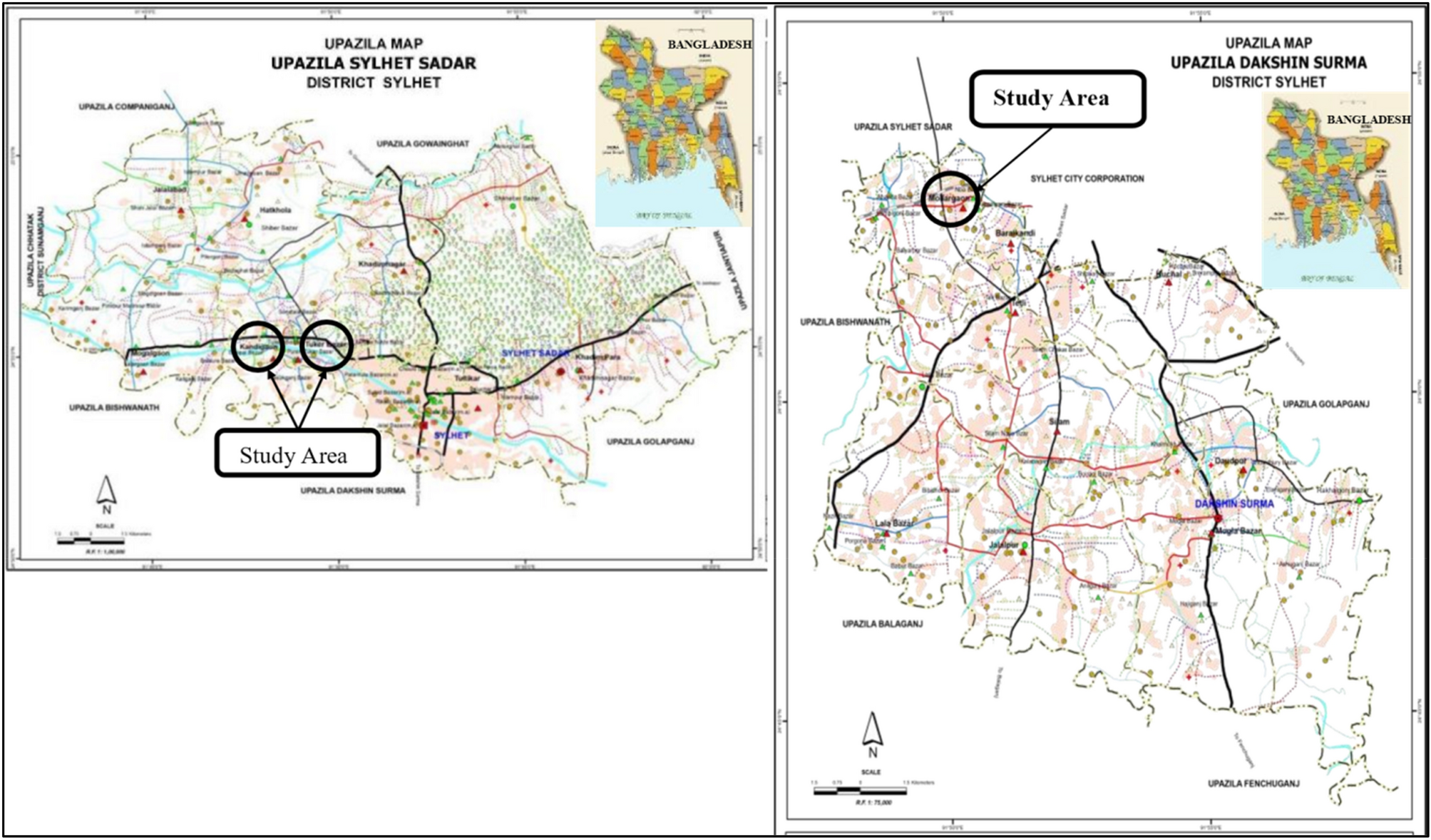

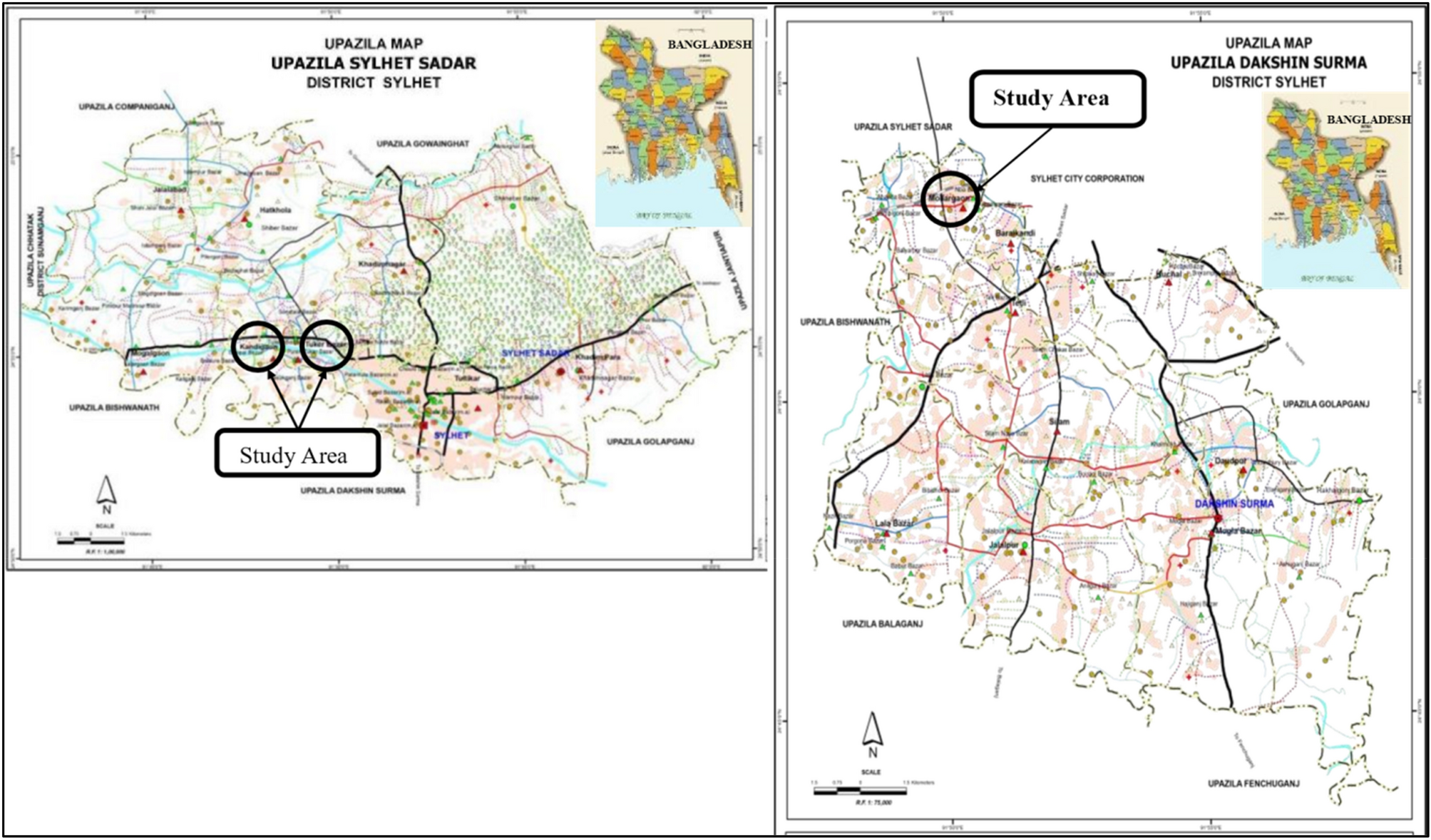

Study Of Nitrate Levels In Fruits And Vegetables To Assess The Potential Health Risks In Bangladesh Scientific Reports

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

New Bin Certificate Pdf Government Of The People S Republic Of Bangladesh National Board Of Revenue Mushak 2 3 Customs Excise And Vat Course Hero

Bangladesh Banknote Currency High Resolution Stock Photography And Images Alamy